Join 1,800,000+ of Canadians taking control of their finances online

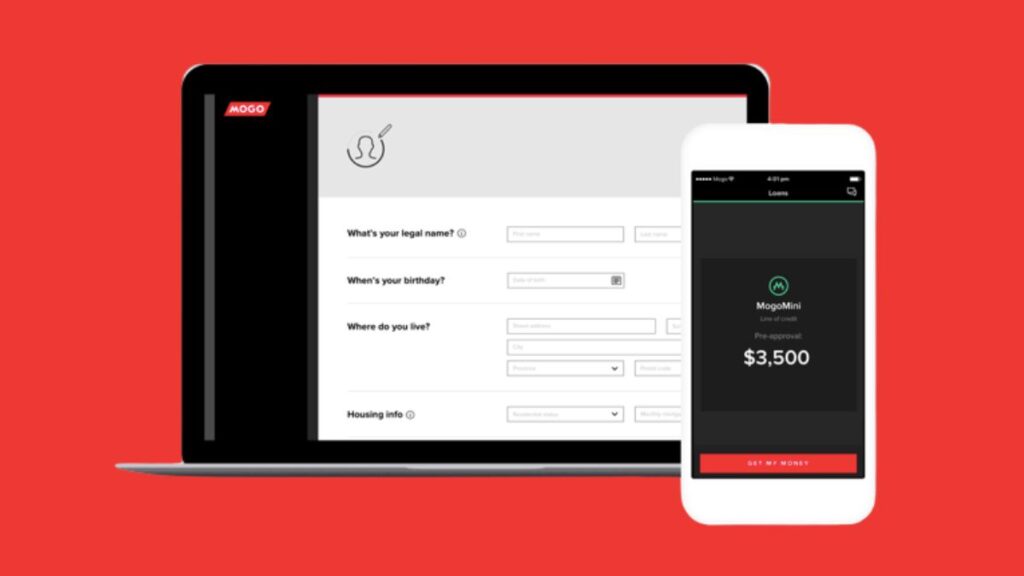

Get Pre-Approved in 3 Minutes for a Mogo Personal Loan up to $35,000

Anúncios

Financial situations require thoughtful decisions

Many Canadians face unexpected financial needs and limited access to traditional credit, especially in urgent or transitional situations.

The lack of clear, accessible credit options can lead to costly decisions and solutions that do not match the applicant’s real circumstances.

That’s why having a clear loan offer—with defined terms, digital tools, and available support—can help you stay in control from day one.

A digital credit alternative with clear terms

Mogo provides personal lines of credit with no-obligation pre-approval in minutes, without affecting your credit score, fully managed through their app or site.

Users report ease of application, full payment visibility, and the opportunity to improve conditions through consistent, responsible repayment.

Consider this solution if you value convenience, clarity, and digital control. Full loan details are accessible in your official dashboard.

Know the criteria before you apply

Before applying for any credit product, review your monthly income and expenses to confirm you can handle the proposed payments comfortably and consistently.

Also, assess whether the loan terms align with your short- and long-term financial goals, including your ability to manage interest rates and due dates.

| RequirementsBenefits | |

|---|---|

| Minimum age: 18 | Loan amounts from $500 to $35,000 |

| Canadian residency | Repayment terms from 6 to 60 months |

| Verifiable income | Variable rates based on individual credit |

| Active bank account | Real-time digital repayment dashboard |

| Credit history | 100-day satisfaction guarantee on conditions |

| Valid email and mobile | Support via app, site, and live chat on weekdays |

Understanding the conditions is key—choose based on your financial priorities and repayment capacity.

Review the pros and cons before deciding

Understanding both the strengths and drawbacks of a loan product helps prepare you for realistic repayment and service expectations.

It also supports a more informed decision, ensuring the offer you choose aligns with your financial capacity, timeline, and long-term credit goals.

| Advantages | Disadvantages |

| Fully digital and fast application | Higher APRs for certain credit profiles |

| Clear terms before commitment | Not available in all Canadian provinces |

| Smart alerts and mobile notifications | Support only during weekday business hours |

| Pre-approval without credit impact | Income documentation required |

| Potential for “Level Up” credit increase | No auto-renewal or refinancing within platform |

| 100-day satisfaction guarantee | Maximum loan amount depends on the product type |

Compare your options carefully and assess how this loan would fit into your current financial strategy.

Mogo personal loan is a solution for those who need fast access to credit with digital control and clearly stated conditions from the beginning.

It’s especially suitable for moderate-risk profiles or those who have difficulty getting approval from traditional financial institutions.

The app and dashboard tools help users stay organized, with alerts, structured payments, and accessible support.

Personal Loan

Mogo

If you’re seeking a more educational and comparison-focused alternative, Borrowell may be a strong option to consider.

Borrowell gives access to offers from multiple lenders, plus free credit score monitoring and personalized suggestions based on your credit profile.

It’s a helpful solution for Canadians looking to improve financial planning and compare rates in a more informed way.

Recommended Content