Anúncios

Get to Know Fairstone Personal Loan

Fairstone offers personal loan solutions that suit many Canadians’ needs, with flexible access to secured or unsecured borrowing options.

These loan products from Fairstone are designed to accommodate a wide range of credit histories, making them a practical option across financial situations.

- Minimum amount: $500

- Maximum amount: $60,000

- Repayment term: Varies by loan type and amount

- Minimum APR: Depends on credit profile

- Maximum APR: Based on risk and loan type

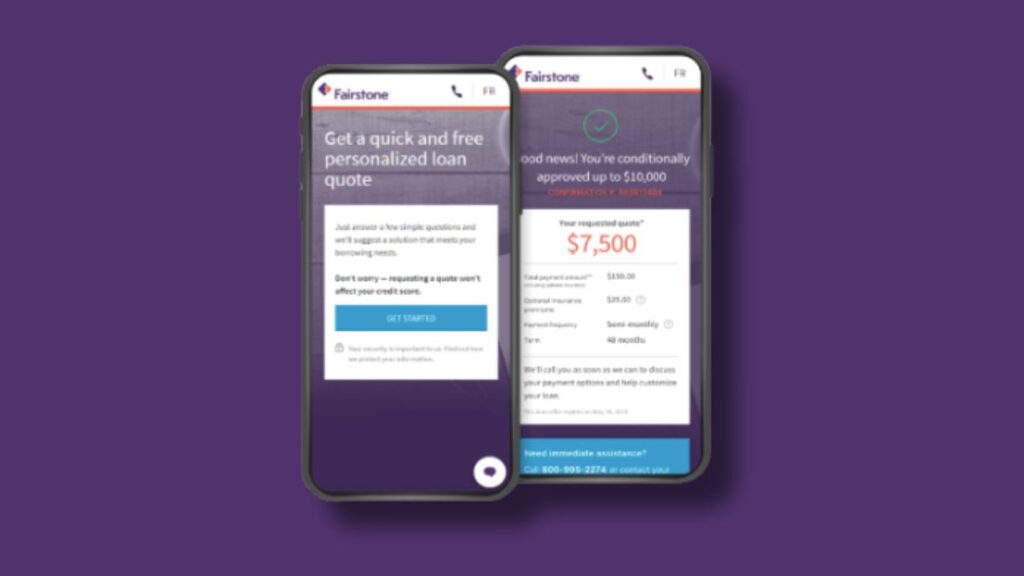

You can complete your personal loan application with Fairstone online, quickly and securely, starting from the comfort of your home.

If in-person service is preferred, Fairstone provides support at more than 250 branch locations across Canada, with specialists ready to help.

With flexible repayment terms, a personal loan through Fairstone can be structured to align with your budget and credit profile.

Loan

Fairstone

What you need to know about Fairstone personal loan

Unexpected expenses can create stress. A Fairstone personal loan provides access to funds when other sources are not available.

Many Canadians face credit challenges. Fairstone offers a loan path that’s accessible even with limited or fair credit histories.

The application is online and simple. If preferred, you can also visit a branch to receive help from a loan specialist.

Loan amounts are flexible, and approval times are fast. You can usually receive funds in as little as 24 hours.

Fairstone personal loan options include secured and unsecured formats, making it easier to match your financial situation.

Support is available throughout the loan process. Fairstone teams are trained to offer clear, helpful advice at each step.

Pros and Cons of Fairstone’s Personal Loan Options

Using a Fairstone personal loan can be helpful for many borrowing needs, but it’s important to understand both the pros and cons.

Some borrowers may find better terms elsewhere. Evaluate if Fairstone meets your specific needs and repayment ability.

Key Benefits of Choosing a Fairstone Personal Loan

Fairstone provides flexible personal loan options tailored to a variety of borrower profiles, financial needs, and credit histories across Canada.

- Access available with fair or limited credit history

- Quick application process with online or in-branch support

- Loan amounts up to $60,000 available

- Funds can be received in as little as 24 hours

- Clear repayment terms that can match your budget

- Long-established institution with national presence

Fairstone loans combine human-centred guidance with digital tools to provide personal support and convenient service throughout the Canadian lending process.

Considerations Before Applying for a Fairstone Personal Loan

It’s important to understand certain limitations that may apply when considering a personal loan through Fairstone’s borrowing options in Canada.

- APR can vary widely based on credit profile

- Some loans may require collateral

- Not all borrowers will qualify for larger amounts

- Branch availability may differ by region

- Loan terms might not suit short-term borrowing

- Online-only competitors may offer lower rates

Take time to consider these aspects in detail to determine if a Fairstone loan aligns well with your long-term financial plan and needs.

How to Apply for a Fairstone Personal Loan

You can apply for a Fairstone personal loan online or at a branch, depending on what’s most convenient for your situation.

Eligibility & Requirements

| Requirement | Description |

|---|---|

| Minimum age | 18 years old or legal age in your province |

| Residency status | Canadian resident with valid identification |

| Credit history | Accepted with various credit backgrounds |

| Proof of income | Required to assess ability to repay |

| Loan type | May require collateral for secured loans |

Ensuring you meet these eligibility criteria may significantly improve your chances of approval when applying for a Fairstone personal loan in Canada.

Application Process for Fairstone personal loan

Begin the process by determining your borrowing needs and reviewing Fairstone’s eligibility criteria to ensure a personal loan is a suitable option.

- Visit the Fairstone site or a local branch

- Provide basic personal and financial information

- Review your quote with no impact to your credit score

- Finalize your application online or in person

- Receive funds, sometimes within 24 hours

A Fairstone personal loan offers a straightforward process supported by digital tools and branch access.

How to Contact Fairstone

If you have questions or need support, Fairstone offers several ways to get assistance across its services and subsidiaries.

- Phone: Call 1-800-995-2274, Monday to Friday, 8 a.m. to 8 p.m. (local time)

- Branch: Visit any of the 250+ Fairstone locations across Canada for personal support

- Live Chat: Available on their website during business hours for real-time help

Support is available in English and French. Fairstone representatives are trained to guide you through every step of the borrowing process.

Additional services such as auto loans and digital lending (through Fig, a Fairstone subsidiary) have their own contact paths. If you’re unsure, calling the main number is the best way to be directed to the right service team.

Important: Fairstone will never request personal information or banking access through email, text, or phone unless you’re interacting securely through their platform. Report suspicious messages to your local branch or authorities.

Representative Example of a Fairstone Personal Loan

| Concept | Unsecured Loan | Secured Loan |

|---|---|---|

| Loan amount | $10,000 | $25,000 |

| Term | 48 months | 72 months |

| Interest rate | 29.99% | 21.99% |

| Monthly payment | $395.80 | $469.12 |

| Total repayable | $18,998.40 | $33,776.64 |

This example compares how total loan cost varies based on loan type, amount, interest rate, and term. The secured option allows for larger amounts and lower rates.

Ensure your monthly budget supports timely payments. Late or missed payments can increase the total cost and impact your credit score.

Always consider the APR and full repayment timeline to understand how much you’ll actually pay over time—including both principal and interest.

Check Fairstone’s official documentation for final conditions. Rates, fees, and terms may vary depending on your credit profile and location.

Compare Other Financial Alternatives in Canada

Which type of alternative would you like to compare? For example: line of credit, credit card, payday loan?

A Fairstone personal loan is flexible and supports a variety of borrower profiles, including those with fair credit.

Unlike payday loans, a Fairstone loan offers longer repayment periods, larger amounts, and support throughout the process.

Now, let’s say you choose a credit card alternative. These typically offer revolving credit and are better for smaller, ongoing expenses.

However, credit cards may carry higher interest rates, and minimum payments can lead to long-term debt if not managed carefully.

Recommended Content