Anúncios

How Mogo Personal Loan Works and What to Expect

Mogo personal loan is available for those seeking flexible credit access with online application and behavioural rate incentives.

This product is intended for Canadians who may not qualify for traditional loans but still want access to timely personal credit.

Loan offers are personalized based on credit behaviour, and users may benefit from lower APRs through consistent repayment and on-time account management.

It’s a practical solution for people who want a fully digital experience without extensive paperwork or in-person appointments to complete the loan process.

- Minimum amount: $500 (MogoMini), $1,000 (Standard Loan)

- Maximum amount: $3,500 (MogoMini), $35,000 (Standard Loan)

- Repayment term: 6 to 60 months (Standard Loan)

- Minimum APR: 9.9% (Standard Loan)

- Maximum APR: 47.7% (MogoMini)

Personal Loan

Mogo

Mogo offers a stress-free borrowing experience with Smart Alerts and no early repayment penalties, making it easier to stay on track.

Loan approval often depends on your credit behaviour and repayment consistency, which can also help lower future APRs.

With on-time payments, users may qualify for Level Up credit increases—encouraging responsible borrowing and rewarding financial control.

Important Considerations for Mogo Personal Loan

One major feature is Mogo’s 100-day satisfaction guarantee. If unsatisfied, you may repay the principal and receive a refund on interest and fees.

Limited credit options can affect Canadian residents in urgent financial situations. Mogo provides a digital alternative for many.

High APRs may limit long-term affordability, but clear terms and behavioural incentives are features of the Mogo personal loan.

Some users prefer online platforms to avoid paperwork. Mogo personal loan allows digital applications and account management.

People with past credit issues often find difficulty with bank loans. Mogo provides non-traditional criteria for loan consideration.

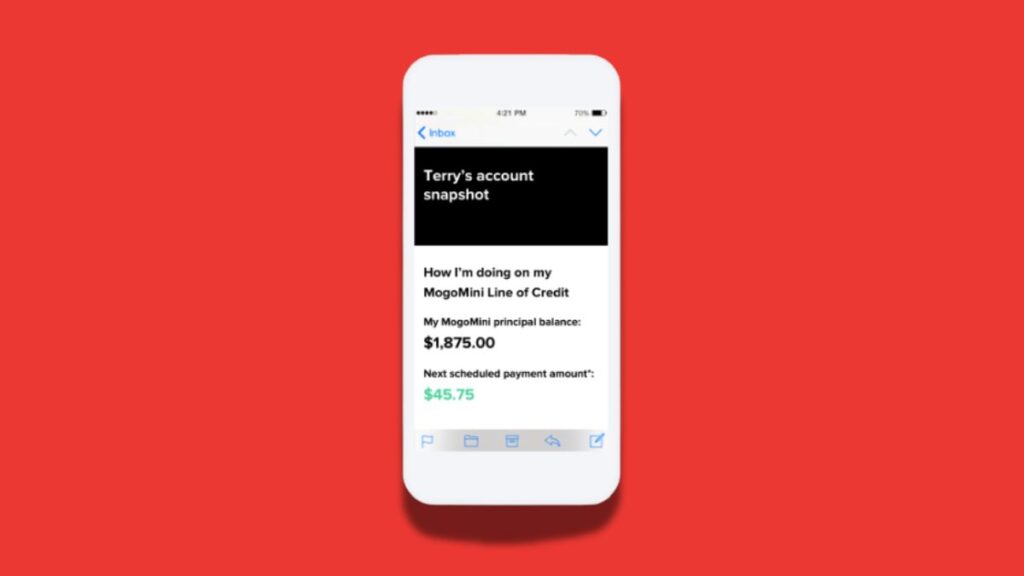

Digital loan monitoring through Mogo app offers visibility over payments, rates, and account updates. Clear repayment information and loan summaries are available through Mogo app and online portal for active users.

Evaluating the Pros and Cons of Mogo Personal Loan

Understanding the structure of a Mogo personal loan is essential to evaluate whether the terms and process align with your financial situation and borrowing expectations.

Applicants are encouraged to reflect on their financial goals, budgeting discipline, and monthly capacity before deciding if a Mogo personal loan is appropriate.

Advantages of Choosing a Mogo Personal Loan

Mogo personal loan offers online applications and repayment insights that help users maintain payment schedules and improve credit standing.

- Transparent online dashboard to track loan balance

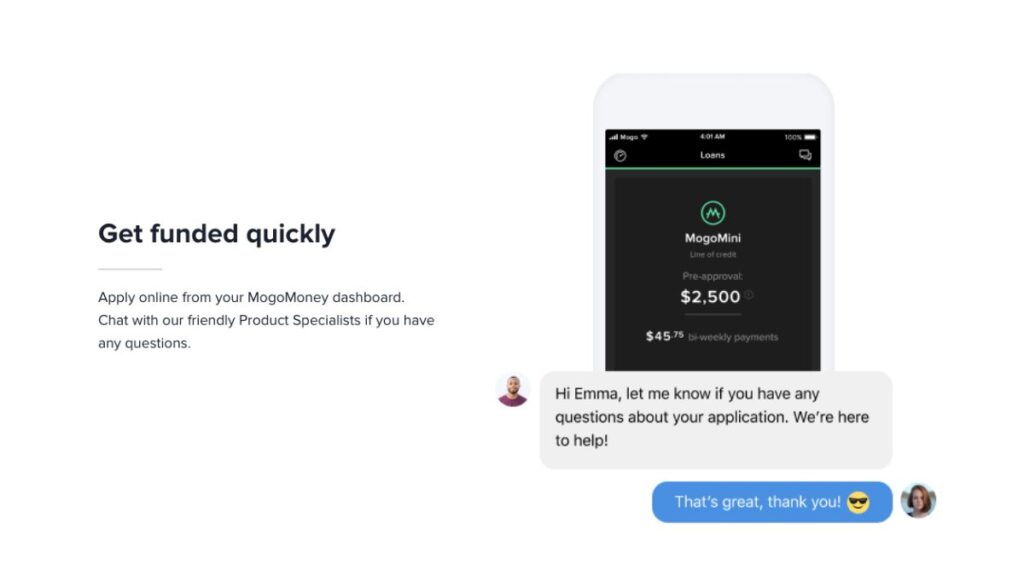

- Quick application with potential same-day response

- Lower APRs possible with responsible repayment

- Mobile app for account and credit monitoring

- Flexible terms for different financial needs

- Pre-approval without credit score impact

Mogo’s platform suits users seeking speed, flexibility, and financial visibility through an integrated app and web portal.

Limitations to Consider Before Choosing a Mogo Personal Loan

Despite its convenience, a Mogo personal loan may not be ideal for all credit profiles or long-term borrowing needs.

- High maximum APRs for higher-risk borrowers

- Not available in all Canadian provinces

- Requires stable income verification

- Customer service limited to business hours

- Some conditions vary by location

- No automatic renewal or refinancing options

Evaluate all cost components of a Mogo personal loan before making a decision, especially if your credit score is below average.

Ways to Start Your Application for a Mogo Loan

You can apply for a Mogo personal loan online, using your device to complete a quick eligibility and identity verification process.

Eligibility & Requirements

| Requirement | Description |

|---|---|

| Minimum age | 18 years old or older |

| Residency | Canadian resident with valid ID |

| Credit history | Varies; no perfect score required |

| Proof of income | Consistent monthly income required |

| Bank account | Active Canadian chequing account |

| Contact info | Valid email and mobile phone number |

Applicants should confirm details directly with Mogo, as eligibility and availability may vary by province.

Step-by-Step Guide to Mogo Personal Loan Application

Mogo personal loan applications can be completed online, offering a simplified path to funds for approved applicants.

- Website Access – Go to the official site using a secure browser on your device.

- Pre-approval Start – Click on “Get Pre-approved” to begin your application and receive a preliminary loan assessment.

- Identity Verification – Provide personal identification and proof of income as requested to confirm your eligibility.

- Terms Review – Read through the proposed loan details, including APR, repayment term, and total repayment amount.

- Digital Signature – Accept the conditions and sign the contract securely using the online platform.

- Account Monitoring – Use the Mogo app to track payments, monitor balances, and receive notifications.

Mogo also offers a 100-day satisfaction guarantee: repay only the principal and receive a refund on interest and fees if not satisfied.

Example Scenario of a Mogo Personal Loan in Canada

| Concept | Detail |

| Loan amount | $5,000 |

| Term | 36 months |

| APR | 29.9% |

| Monthly payment | $214.32 |

| Total repaid | $7,715.52 |

Note: This simulation is for informational purposes only. Actual APR and terms may vary depending on credit and province.

Carefully assess your repayment ability, including monthly obligations and income consistency, before agreeing to any personal loan terms.

Thoroughly compare the full APR and associated costs with at least two other Canadian lenders offering similar personal loan products.

Review all official Mogo loan conditions and contract clauses before signing, ensuring you understand responsibilities, fees, and repayment expectations.

Contacting Mogo: Availability and Support

You can contact Mogo’s support team by phone, email, or live chat during standard weekday business hours in your local time zone.

The official email address is [email protected]. You can also call their support line at 1-800-980-6646 if you prefer phone assistance.

Live chat is available on the Mogo website. Outside business hours, the help centre and Mogo app remain accessible for account support.

All account features—including repayments and updates—can be monitored through the app or by signing in securely on the official Mogo website.

Compare Mogo with Other Financial Solutions

If Mogo doesn’t meet your needs, another strong option in the market is Borrowell, especially for those focused on long-term credit health.

Borrowell provides access to a broader lender network, letting you compare personal loan offers and monitor your credit for free over time.

Its platform is particularly appealing for Canadians with stronger credit profiles who want to manage their financial trajectory using educational tools.

While Mogo emphasizes speed and simplicity, Borrowell may be better suited for users seeking personalized credit-building resources and lower rates in the long term.

Recommended Content